us exit tax rate

Last weeks Taxation 101 Where To Live Tax-Free essay was well received but raised lots of questions from American readers including many to do with what Id say is maybe the most misunderstood US. The phrase exit tax that we use consists of four different ways in which.

Exit Tax Us After Renouncing Citizenship Americans Overseas

To clarify this is not a separate or an additional tax.

. Tax person may have become a US. If the rate is 25 per cent but no tax is paid in the new country of residence there is no double tax. Exit Tax Expatriation Planning.

Green Card Exit Tax 8 Years Tax Implications at Surrender. Through the FEIE US expats can exclude up to 107600 of their 2020 earnings from US income tax. Once you have paid the exit tax either in a giant lump sum up front or because of the 30 withholding made on payments as you receive them you have cash in your pocket.

Realized at the time of inheritance or gift those deemed gains will be subject to the exit tax at the rate of 15315 in most cases even if the donordecedent does not leave Japan. Presuming the person who expatriates qualifies as a covered expatriate they will have to conduct an exit tax analysis using Form 8854. Having planned and executed an entry into the US.

Legal Permanent Residents is complex. Tax on individualsthe Exit Tax Americans have to pay when they give up their US. The US imposes an Exit Tax when you renounce your citizenship if you meet certain criteria.

In the United States the expatriation tax provisions under Section 877 and Section 877A of the Internal. You are free to move about the planet. However the US government does charge a fee of 2350 to relinquish citizenship.

Tax resident or citizen by virtue of having acquired a green card or citizenship see Garcia Tax Planning for High-Net-Worth Individuals Immigrating to the United States The Tax Adviser April 2016 and Garcia and Qian Tax Planning for a. If you are covered then you will trigger the green card exit tax when you renounce your status. As provided by the IRS.

Exit Tax Consists of Several Things. In some cases you can be taxed up to 30 of your total net worth. Also one may be able to claim a foreign tax credit in the other country based on the Canadian tax depending on the tax rules of that country 3 PAYING A DEPARTURE TAX.

The exit tax is an income tax on 1 unrealized gain from a deemed sale of worldwide assets on the day prior to expatriation. This article is about tax applied to individuals who move out of a country. In 2019 the maximum was 105900.

As the percentage of this amount that you must pay as part of your exit tax is based on your marginal tax rates it is likely to be different for everyone currently it cannot be any higher than 238. This tax is based on the inherent gain in dollar terms on ALL YOUR ASSETS including your home. If the profit on your assets is over 725000 you only have to pay exit tax on the amount that is over the threshold.

For other kinds of exit tax see Exit tax. The IRS requires covered expatriates to prepare an exit tax calculation and certify prior years foreign income and accounts compliance. An expatriation tax or emigration tax is a tax on persons who cease to be tax resident in a country.

Citizen renounces citizenship and relinquishes their US. What is the exit tax for renouncing US citizenship. US Exit Tax IRS Requirements.

This often takes the form of a capital gains tax against unrealised gain attributable to the period in which. Green Card Exit Tax 8 Years. Currently net capital gains can be taxed as high as 238 including the net.

And 2 the deemed distribution of IRAs 529 plans and health savings accounts taxed at ordinary income rates. It will be as though you had sold all of your assets and the gain generated was viewed as taxable income. The total amount of the gift is reduced by the annual gift exclusion 13000 in 2011 and then subject to the highest marginal.

Citizens Green Card Holders may become subject to Exit tax when relinquishing their US. The takeaway The exit tax laws have the potential to both accelerate and increase taxes on unrealized capital gains. Status they are subject to the expatriation and exit tax rulesBut the rules are not limited to.

The IRS will not tax you a second time. The law requires sellers of New Jersey homes to pay the state tax in advance of moving of either 897 of the profit on the sale of their home or 2 of the total selling price whichever is higher. The exit tax is a tax on the built-in appreciation in the expatriates property such as a house as if the property had been sold for its fair market value on the day before expatriationThe current maximum capital gains rate is 238 which includes the 20 capital gains tax and the 38 net investment income tax.

The exit tax currently applies to Japanese. For example if you made a profit of 750000 on your assets exit tax would only apply to 25000 of that amount. However a retirement fund such as a 401K is a free tax income as you havent paid any tax on this.

The IRS Green Card Exit Tax 8 Years rules involving US. If the IRS can rely on tax withholding rules to assure full collection of income tax the covered expatriate pays tax at a 30 rate on US. The IRS adjusts this amount each year for inflation although the Trump tax reform in 2017 changed the inflation index to.

The most important aspect of determining a potential exit tax if the person is a covered expatriate. Citizen will be subject to provisions of the exit tax. Any gifts or bequests that you make as a covered expatriate to a US.

In actuality the New Jersey Exit Tax as its referred to has been likened more to urban legend than fact by CPAs. Tax system a formerly non-US. An expatriation tax is a tax on someone who renounces their citizenship.

The general proposition is that when a US. The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain. Once you renounce your US citizenship you will no longer have to pay US taxes.

Source income as it is received. Generally if you have a net worth in excess of 2 million the exit tax will apply to you. The Exit Tax Planning rules in the United States are complex.

The Taxes That Raise Your International Airfare Valuepenguin

What Is Expatriation Definition Tax Implications Of Expatriation

Exit Tax Us After Renouncing Citizenship Americans Overseas

Four Ways To Legally Avoid Paying Us Income Tax

An Overview Of The New Jersey Exit Tax Vision Retirement

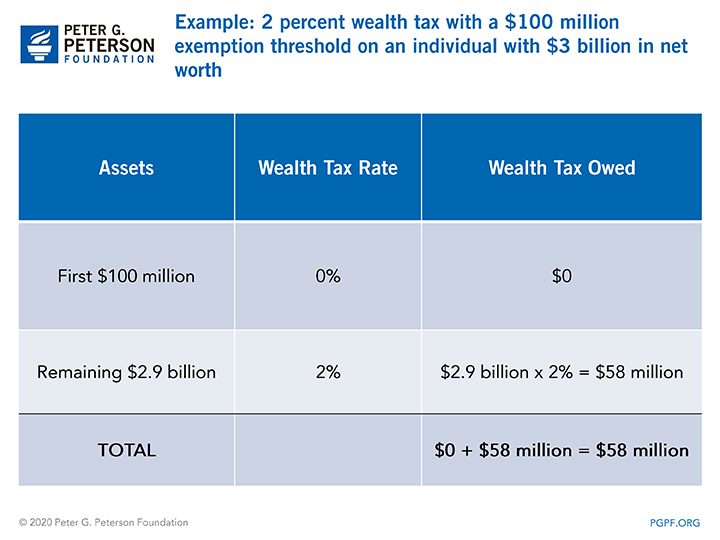

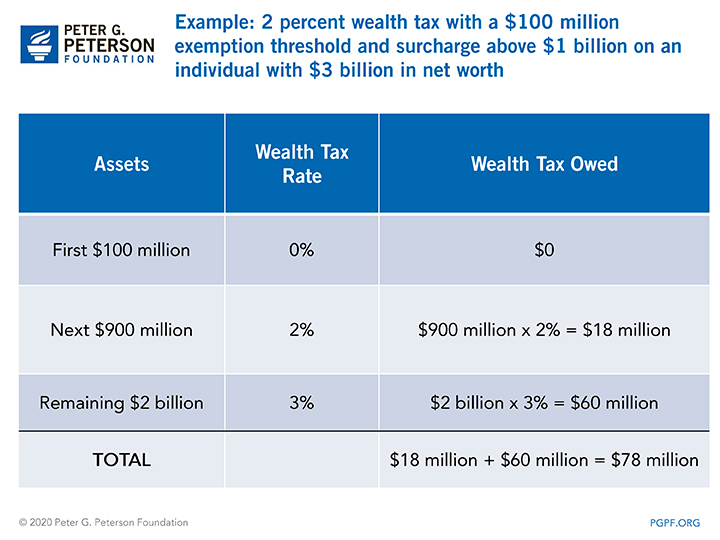

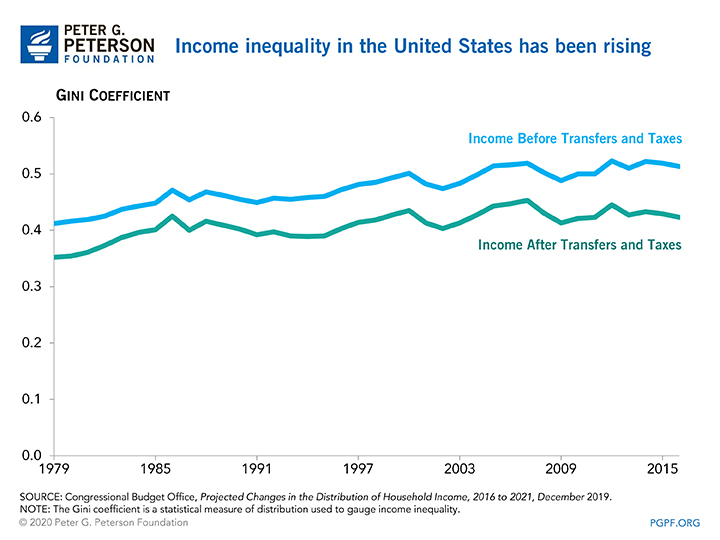

What Is A Wealth Tax And Should The United States Have One

What Is A Wealth Tax And Should The United States Have One

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

What Is Expatriation Definition Tax Implications Of Expatriation

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

What Is A Wealth Tax And Should The United States Have One

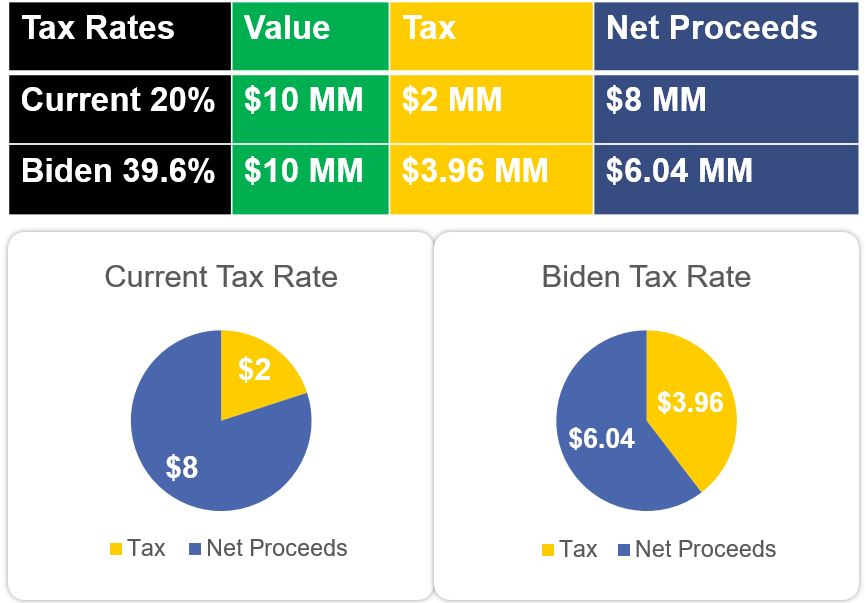

The Proposed Biden Tax Plan Will Double Taxes When Selling Your Business Affinity Ventures

Benefits Of Renouncing Us Citizenship And Retiring With Ease

Exit Tax Us After Renouncing Citizenship Americans Overseas

Green Card Exit Tax Abandonment After 8 Years

Exit Tax Us After Renouncing Citizenship Americans Overseas

What Is A Wealth Tax And Should The United States Have One

Tas Tax Tips American Rescue Plan Act Of 2021 Individual Tax Changes Summary By Year Taxpayer Advocate Service

What Is Expatriation Definition Tax Implications Of Expatriation